If you got your first job over a decade ago, you might remember that if you did well at work you’d probably find an envelope with some cash on your desk. Or maybe you’d get some coupons that could be spent only at select places. You’d stuff it into your wallet and go out to spend it.

It was a little cumbersome.

And that’s the problem the founders of Zaggle Prepaid Ocean Services (don’t ask why it says Ocean) saw back in 2011. They wanted to make the lives of employees simpler. And that of the company too. So they introduced cards that could do the good work instead.

But wait…Zaggle isn’t a bank or an NBFC. Then how could it issue cards?

The trick is Prepaid Payment Instruments (PPIs).

Think of PPIs as a digital wallet or card that functions like a mini bank account. It could be a gift card that someone can top up with money. And the recipient of the card can use this “stored” money to make any purchase they want. And you don’t need to be a bank to deal with PPIs. You can simply partner with them to get the ball rolling.

And that’s what Zaggle did for nearly 3 years. They put their head down and went after improving the rewards and recognition (R&R) market through these cards.

Once they kind of had that in the bag, they turned to the next thing.

Again, rewind a decade. And you probably remember being issued some paper slips along with your monthly salary. You could use them to pay for food at the cafeteria. Or when you bought groceries. These expenses — up to a limit — could be claimed tax free. But the bits of paper were a headache. You could easily misplace it and there would be no way out.

So in 2016, Zaggle saw it as the next logical step. They’d launch a multi-wallet card along with Visa. Employees could use it online or offline. It could be for meal vouchers. It could be for transport. It could be for some other thing. But it was simple.

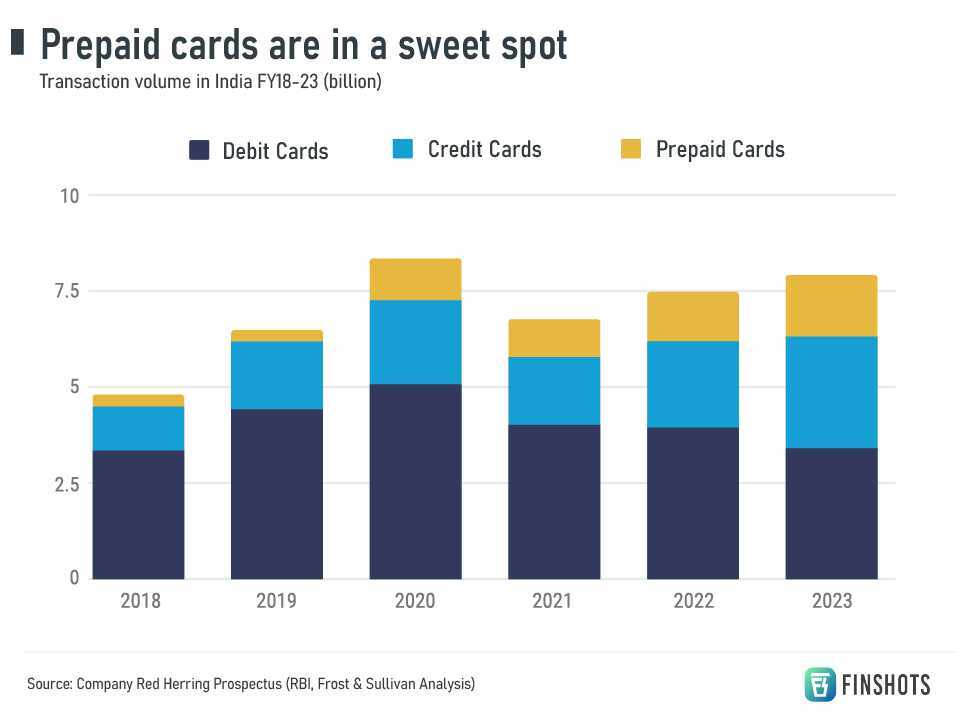

Zaggle’s evolution as a fintech had begun. And they were in the right place at the right time as the use of such prepaid cards began to explode.

Then came the biggie — expense management.

Say you had to travel to another city for an emergency meeting with a client, you might have had to swipe your own card. Then ensure that you carefully saved receipts right from the cup of coffee you had at the airport to the taxis to the food. And once you submit it, maybe wait for a month before it was reimbursed.

Now ask the HR team at your company and they’ll probably tell you that they don’t want to deal with the tedious task of tracking expenses and reimbursements of the employees. They don’t want to deal with bits of paper and receipts. And in large organizations, this could be quite voluminous. The HR would rather avoid this mundane stuff and pay attention to more value adding activities that can keep everyone engaged and motivated.

And Zaggle saw the opportunity to expand its business in this domain too. It began to create Software that would digitize this process. And help companies manage overall expenses on a single dashboard. Zaggle could sell it for a subscription. And they even had software to manage employee rewards and recognition. It wasn’t just about the cards.

Now there’s a bunch of other little stuff that they do too. But that’s the gist of the business segments that Zaggle dabbles in. It’s quite diversified. And you see how they’re a fintech + SaaS company now, don’t you?

Anyway, that means Zaggle’s revenue stream is quite diversified too.

For starters, there’s revenue from corporate clients for issuing reward points (Propel points) to their employees. These are the points that can be redeemed for stuff on the platform. Then there’s the money they earn from banking partners whenever prepaid cards are swiped at offline or online points of sale which is part of what they call Program fees. They charge customers multiple fees for implementing the products. And they also earn a recurring subscription from the software they sell. And they’ve also started earning commissions from their ‘value added services’ — for instance, they’ve tied up with Fibe and Tata Securities for loans and wealth management products that employees can avail.